By Tony Adibe

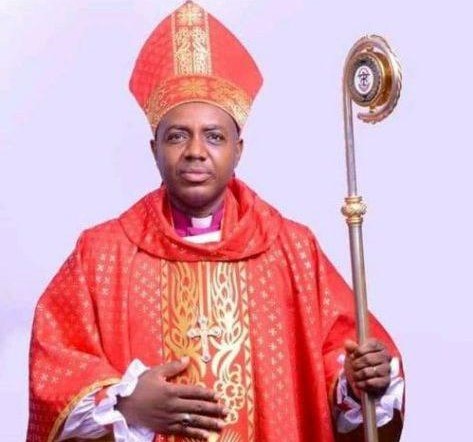

The Bishop, Diocese of Nike in Enugu State (Anglican Communion), the Rt. Rev. Christian Onyia, has tasked various tiers of government on the need to focus on job creation to reduce the increasing insecurity and terrorism in Nigeria. Bishop Onyia gave the task while delivering his Bishop’s Charge at the 2nd Session of the 6th Synod of the Diocese ongoing at the Church of the Beatitudes, Trans-Ekulu, Enugu.

The bishop noted that terrorism and ransom taking might have reduced “but not because of currency redesign as espoused by the CBN and federal government”. He said the truth is that most of the hoodlums got busy with election activities. Some were engaged as thugs and hit men, while others travelled to their primary locations either to vote or mobilise for their preferred candidates.

“This, without any doubt, underscores the importance and impact of employment on crime and insecurity reduction. An idle mind, they say, is the devil’s workshop, the same way a hungry man is said to be an angry man.

“Government needs to focus more attention on job creation to engage our teeming jobless youths. It is a better strategy to combat crimes rather than the sums spent on almost failed currency redesign and other frivolous/fictitious government projects and programmes.

“The 2023 Global Terrorism Index ranked Nigeria as the 8th terrorist’s country in the world with food security, population and water risk as catastrophic threats facing the country. The 2023 Global Risks Report also identified terrorist attacks, debt crises, cost-of-living crisis, severe commodity supply crises, rapid and/or sustained inflation, and employment and livelihood crises as the five major risks facing Nigeria,” according to the cleric.

Bishop Onyia said that in the 2023 Global Hunger Index ranked Nigeria 103 out of 121 countries, yet the President refused to assent the constitutional amendment bills on food security.

He said: “Specifically, the President withheld assent on “Bill, Number 65, 2022 (Food Security – Section 16) and a Bill for an Act to Alter the Provisions of the Constitution of the Federal Republic of Nigeria, 1999, to require the Government to Direct its Policy towards ensuring Rights to Food and Food Security in Nigeria.

“As a nation, we need to deploy more resources and attention towards addressing these existential threats to Nigeria and Nigerians.”

Bishop Onyia also commented on currency redesign/cashless economy. He said that some of the objectives outlined by the Central Bank of Nigeria (CBN) for the Naira Redesign had been achieved while more are not yet met and might not be achieved through the redesign of the currency.

According to him, first, the amount of money in circulation outside the banking system has reduced. However, it is more of winning the battle and losing the war. Onyia noted that the reason behind mopping up the currency outside the banking system was to manage inflation and the exchange rate crisis.

He said: “Unfortunately, despite the reduction in currency outside the banking system from N3.2trn in October 2022 to N1.8trn in January 2023, Nigeria’s inflation rate increased to 21.91 per cent in February 2023 from 21.09 per cent in October 2022.

“The exchange rate increased from N740/$1 in October 2022 to N749/$1 in March 2023 (parallel market), and N434.78/$1 in October 2022 to N460.95/$1 in March 2023 (official rate). The implication is that the CBN is pursuing a wrong policy to address a fundamental/structural problem facing Nigeria.

“The second reason anchored on the supply of clean notes has not been met in any way. Rather, Nigerians have been subjected to hardship like never before to the extent that most families, despite having monies in their bank accounts, have become perpetual beggars. Nigerians are unable to access their money in the bank.”

The cleric argued that how can a country deepen a cashless economy without first ensuring that the needed infrastructure and platform to efficiently and effectively implement the policy are in place.

“Banks have become more fraudulent with the CBN not doing anything to address the issues. Accounts are debited without giving credit to the intended beneficiary accounts and reversals never take place. Market frictions and distortions/disruptions to electronic banking services have not been addressed.

“What has the CBN done to address the issue of debits for failed transactions and delays in executing transactions caused by system failures and/or poor networks? Most times, it takes banks months to resolve and reverse failed transactions.

“In most cases, such transactions are never reversed. What is the incentive for electronic banking? In many urban areas, electronic transactions are greatly limited by poor bank networks, unreliable electricity, and telecommunications services. What a country?

Onyia urged the Federal Government and CBN to obey the ruling of the Supreme Court on the currency redesign without further delay; thus, make cash available and easily accessible to Nigerians to reduce the ongoing hardship imposed on them by the currency redesign policy.