. Carriers take the flak for high pricing, poor communication, others

. Sector growth up 19.7% in 2022

In a far-reaching survey conducted by Phillips Consulting Limited (PCL), Air Peace, and Ibom Air have been adjudged as the most preferred airlines in Nigeria.

According to the survey, Air Peace (31.67%) and Ibom Air (19.58%) jointly control half of the domestic passengers’ market share. Surprisingly, 16.24% of passengers do not prefer any airline. Arik ranks as the third most preferred airline by passengers.

The consistency of Green Africa at bottom of the most preferred and least preferred airlines was attributed to its new entrant and brand awareness among respondents.

Ironically, almost half of the respondents 47% identified Air Peace, Arik Air, and Aero Contractors as their least desired airlines. 41% selected Dana, Azman, Overland, United Nigeria, Max Air, Ibom, and Green Africa as their least preferred airlines. These results according to PCL appear to contradict the results of the most preferred airlines.

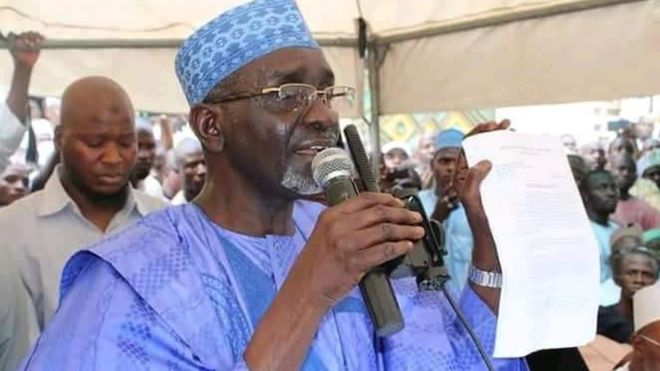

According to the majority of respondents, Air Peace was their least preferred airline because of the carrier’s poor communication of information and high pricing, and rated as the most expensive domestic airline to travel. The poor communication issue connects the dots in the clash between the Emir of Kano and Air Peace in February 2022.

For Dana, 36 percent of respondents who chose Dana as their least preferred airline are wary of the airline’s poor communication of information and low safety standards citing the damning NCAA’s report on the airline. The carrier is expected to resume flight services on November 9, 2022, after its comprehensive audit by the Nigerian Civil Aviation Authority (NCAA).

Aero, Max Air, Arik, and Ibom Air also received flak for poor communication of information for their choice as least preferred airlines, United Nigeria Airline and Azman were picked by respondents as the least preferred airlines for the poor record of timeliness and poor communication of information.

The survey shows that more than half (56%) of the respondents selected the Murtala Muhammed Airport, Lagos as their most frequent point of departure. The Nnamdi Azikiwe Airport is chosen by more than a quarter (30%) of respondents, whereas just 4% of respondents utilize the Mallam Aminu Kano International Airport.

Moreover, just 10% of respondents utilize the Eastern region-based airports (Calabar, Enugu, and Port-Harcourt airports). On a positive note, over half of the passengers are satisfied with the availability of baggage trolleys and the ease of crowd control at the airports.

However, most passengers experience difficulties with ground transportation, shuttle services, and parking facilities at various airports in Nigeria. Also, travelers with physical disabilities or health conditions are considerably more likely to have difficulties in navigating airports and flying.

The Managing Director of Phillips Consulting Limited (PCL), Rob Taiwo said the report was structured into three parts namely the global aviation industry overview and outlook, the Nigerian aviation industry, and the Nigerian customer satisfaction survey.

For the global aviation industry overview and outlook, Taiwo admitted that the global aviation industry was yet to fully rebound from the COVID-19 pandemic due to its more prolonged than expected impact, adding that the recovery observed in early 2021 was interrupted by the Omicron virus, which led to new travel restrictions preventing the sector from scaling up.

“In 2023, while we anticipate the global aviation industry to sustain the growth trajectory, the ongoing Russian-Ukraine crisis will potentially undermine full recovery. The International Air Transport Association (IATA) that by 2040, global passenger traffic will still be 6 percent below the pre-pandemic forecast, underscoring the long-lasting impact of the pandemic crisis”, he said.

On the Nigerian aviation industry, Taiwo said following the global trend, the COVID-19 pandemic also negatively impacted the country’s aviation sector, stressing that the local aviation sector recorded negative growth of 36.98 percent in 2020 from a Gross Domestic Product (GDP) growth of 13.2 percent in 2019 on the back of the air travel restriction in March 2020.

He however noted that the aviation sector grew by 19.7 percent, returning to its pre-pandemic growth level upon fully reversing the travel restriction in 2021.

He further stated that according to the National Bureau of Statistics (NBS), about 13 million passengers travelled through Nigerian airports in 2021, representing a growth rate of 43.41 percent from the nine million recorded in 2020.

The PCL boss stated that consistent with global trends, growth is undermined by subsisting pressure points, adding that in this segment, they discussed Nigeria’s aviation industry overview, trends shaping the industry, the regulatory framework, analysis of the competitive landscape, SWOT analysis and the outlook of the industry. The PCL aviation customer satisfaction survey is a country-wide survey designed to explore the state of the industry from the passengers’ lens to identify progress and gaps to support strategic transformation.

This year’s survey was carried out between February and July 2022 to understand better domestic air travellers’ perceptions, expectations, and experiences of both airline services and airport experience. A total of 7, 815 responses were obtained by the firm.

Source: Wole Shadare, November 7, 2022.