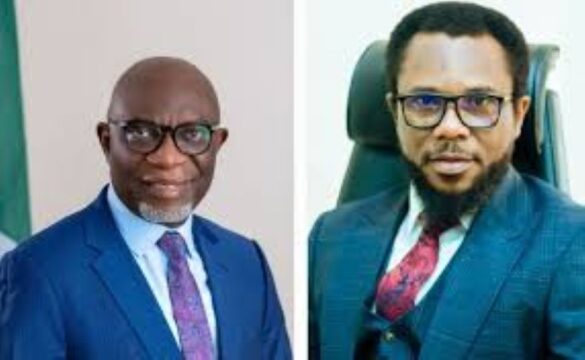

AMCON Managing Director/CEO Mr Gbenga Alade (left), and AMCON Head of Corporate Communications, Mr Jude Nwauzor

The Asset Management Corporation of Nigeria (AMCON), under the leadership of Gbenga Alade, has broken the yoke in recent times, with huge recovery of outstanding debts owed to the Central Bank of Nigeria (CBN) within two years of his appointment.

Alade, as the Managing Director, recovered a historic 3.6 trillion from obligor exposures of over N4 trillion since its inception, covering about 87% within two years of its assumption of duty. AMCON, established by the Central Bank of Nigeria (CBN) in 2010, was created to reinvigorate and recover bank exposures and huge toxic loans owed by individuals, conglomerates, among many others.

The inception of AMCON bailed out ailing banks that returned some of the Nigerian banks to business, after the grand bailout to save both depositors’ funds and customers. On assumption of duty in February 2024, Alade read the riot acts to debtors on the management’s determination to recover every Kobo owed by debtors to boost the economy and return the country’s debt performance to positive stead.

After a series of consultations, litigation, invitations, and a conferment on the modus operandi of repayment as the way forward, Alade asserted that the process of recovering debts from obligors is sacrosanct and uncompromising.

With the landmark recovery of over N3 trillion in two years, no doubt before the end of the Renewed Hope Agenda of President Bola Ahmed Tinubu’s first tenure, AMCON’s resolve to recover all exposures in the country. The positive development has proved cynics wrong that AMCON’s debt recovery process was lame duck against the regulatory roles.

The advocates of winding down AMCON will be doing a disservice to the country, and allowing bad debts subsist in the country, having recovered funds that were considered irrecoverable and irredeemable in the last two decades.

All hands must be on deck to continue to support the Initiatives, reforms, and transformation agenda of Gbenga Alade towards repositioning AMCON with a view to continuing to carry out its statutory functions. Aside from recovery of toxic debts, AMCON, as an institution, is charged with carrying out supervisory roles, due diligence before availing or by commercial banks in the country, to avoid further pitfalls and recurrence.

The Gbenga Alade-led AMCON is glaringly determined to execute its mandate among many others going forward.